Nigeria’s Debt Crisis and the Moral Failure it Reveals

By Umar Farouk Bala

The recent announcement that Nigeria has repaid a $3.4 billion loan to the International Monetary Fund (IMF) and a N100 billion Sovereign Sukuk bond has been hailed by the government as a milestone in economic reform.

Yet, buried beneath the fanfare is a sobering detail: Nigeria still faces additional payments in the form of “Special Drawing Rights” charges—estimated at $30 million annually to the IMF over the next four years. That adds up to $120 million, or roughly N180 billion.

This celebration hides a painful truth: Nigeria’s debt burden remains dangerously unsustainable, and the cost of servicing it falls not on the political elite, but on ordinary Nigerians already struggling with poverty and hardship.

The IMF loan, taken during the COVID-19 pandemic in 2020, and the Sukuk meant for infrastructure, are being spun as symbols of fiscal responsibility. But these repayments come amid a bleak economic reality.

While the government celebrates, it has dismantled fuel subsidies, eliminated social safety nets, and offered no meaningful improvements in infrastructure, healthcare, or social welfare.

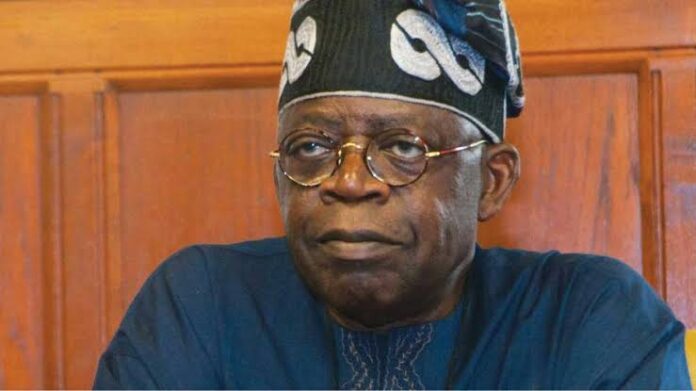

More worrying is the Tinubu administration’s growing appetite for debt. In less than two years, it has borrowed N18.7 trillion—about 25% of the total N75.26 trillion borrowed under President Muhammadu Buhari in eight years.

Under Tinubu, Nigeria’s public debt ballooned from N87.38 trillion in June 2023 to N144.67 trillion by December 2024. External debt alone stands at around $42.5 billion, according to the Debt Management Office.

Despite government reassurances, this level of debt is clearly unsustainable—especially in a country where over 70% live in multidimensional poverty. The touted “GDP growth” and “increased revenues” have yet to bring real relief to average Nigerians.

Read Also:

Worse still, debt servicing now consumes 96% of Nigeria’s annual budget, leaving little for critical investments. The result? Dilapidated roads, underfunded schools, erratic power, and overcrowded public hospitals.

Since fuel subsidies were removed—a rare policy that helped the poor—fuel prices have soared, transport costs doubled, and inflation spiraled. Yet the government calls this progress.

How can repaying debt be a success when Nigerians’ living conditions are worsening?

The government’s claim that foreign investor confidence is rising rings hollow. Foreign direct investment remains weak, manufacturing is shrinking, and international companies are fleeing due to falling consumer purchasing power.

The National Bureau of Statistics reports a 52.3% drop in manufactured goods exports—a clear red flag. The economy remains overly dependent on oil, with little industrial growth or job creation.

Though foreign reserves rose from $3.99 billion in late 2023 to $23.11 billion in 2024, this means little to citizens facing daily hardship—poor electricity, insecurity, heavy taxes, and erratic policies.

The Central Bank’s claim to have cleared foreign exchange backlogs may have helped airlines and multinationals but not Nigerian entrepreneurs struggling to import goods or civil servants whose wages are eroded by inflation.

Instead of celebrating debt repayment, the government should be held accountable for neglecting investments that directly improve people’s lives. Public infrastructure crumbles. Healthcare remains out of reach. Social protection is nearly absent.

If the Tinubu administration truly wants to build confidence, it must invest in Nigerians—prioritizing education, housing, clean energy, and small businesses. It also means real anti-corruption reforms and cutting the bloated cost of governance.

Nigeria’s debt repayments may win praise from elites and credit rating agencies thousands of miles away. But for millions living in poverty and despair, such praise offers little comfort.

Until economic growth delivers real benefits—better roads, decent housing, quality education, affordable food, reliable electricity, and accessible healthcare—Nigeria’s debt burden will remain not just a financial challenge but a moral failure.