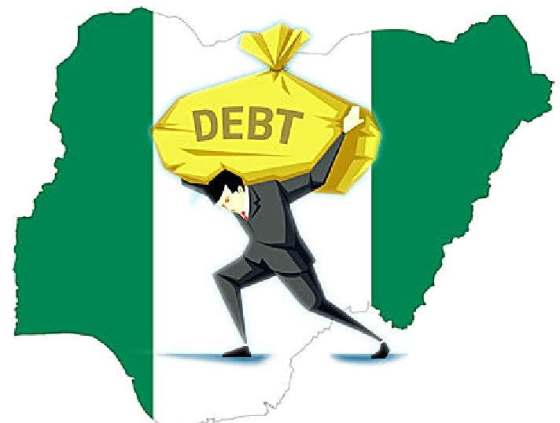

Debt Servicing Costs Rise to N8.9tn – Report

Nigeria’s debt servicing costs have surged to N8.9tn in the first nine months of 2024, surpassing the pro-rata budget of N6.2tn.

In a recent report by Afrinvest, this increase is driven by the country’s rising debt profile, which ballooned from N97.3tn at the end of 2023 to N144.7tn in 2024. The N8.9tn spent on servicing debt in the period represents a significant 58.3 per cent of the nation’s total revenue, placing significant strain on fiscal resources.

According to Afrinvest, the massive debt servicing burden, coupled with recurrent expenditure obligations, has limited the funds available for capital expenditure, which is essential for stimulating economic growth. Despite a 48.7 per cent increase in debt in just one year, Nigeria’s real Gross Domestic Product growth was capped at 3.4 per cent, a clear sign of the pressure on the economy.

Read Also:

“The recent surge in Nigeria’s debt profile has the potential to derail growth momentum, especially if the proceeds are largely deployed to non-CAPEX activities. In nine months:2024, Nigeria spent N8.9tn on debt servicing (budgeted pro-rata: N6.2tn), driven by the surge in debt profile from N97.3tn at the end of 2023 to N144.7tn in 2024,” the report added.

The mounting debt has also contributed to a lowered growth projection by the International Monetary Fund.

Analysts point to key revenue sources, such as crude oil exports and taxes, as remaining under pressure through the remainder of 2025. This stems from both external shocks and self-inflicted challenges, including persistent insecurity in agrarian communities, unrelenting crude oil theft, corruption, and administrative imprudence.

“Key revenue accretion sources, crude oil exports and taxes are likely to remain pressured for the rest of 2025 due to external shocks, and self-inflicted challenges such as insecurity in agrarian communities, unending crude oil theft, corruption, and executive imprudence.”

Nigeria’s external debt service is projected to rise to $5.2bn this year, highlighting growing pressure on public finances despite ongoing economic reforms, Fitch Ratings said.

SOURCE: The PUNCH