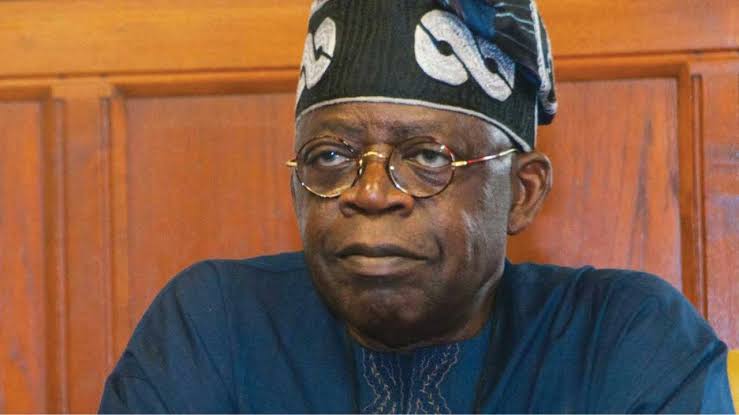

Why Tinubu Replaced FIRS with NRS in Sweeping Tax System Overhaul

In a bold move to modernize Nigeria’s fiscal landscape, President Bola Ahmed Tinubu has signed into law four transformative tax reform bills, effectively dissolving the Federal Inland Revenue Service (FIRS) and establishing a new performance-driven body, the Nigeria Revenue Service (NRS).

At a high-profile ceremony held Thursday at the Presidential Villa in Abuja, the President was joined by leaders of the National Assembly, state governors, and key cabinet officials as he enacted the Nigeria Tax Bill, the Nigeria Tax Administration Bill, the Nigeria Revenue Service (Establishment) Bill, and the Joint Revenue Board (Establishment) Bill.

The landmark reforms mark a decisive shift in the administration of taxes in Nigeria. President Tinubu explained that the overhaul was necessary to build a modern, transparent, and investor-friendly tax regime, one that eliminates multiple taxation, strengthens fiscal federalism, and enhances compliance and service delivery.

“These bills reflect our unwavering commitment to creating a simplified, coherent, and efficient tax system,” Tinubu said, noting that the changes were informed by extensive consultations with stakeholders nationwide.

Under the new legal framework, the Nigeria Revenue Service (NRS) will take over from the defunct FIRS, with expanded responsibilities including non-tax revenue collection. The NRS is designed to be more accountable, performance-based, and technology-driven.

The Nigeria Tax Bill consolidates multiple tax laws, simplifying compliance for individuals and businesses. This bill aims to reduce duplication, clarify obligations, and enhance the ease of doing business.

The Nigeria Tax Administration Bill creates a unified structure for tax administration across federal, state, and local governments. It is designed to promote consistency and efficiency in tax collection, ensuring a coordinated approach across all levels of government.

The Joint Revenue Board (Establishment) Bill sets up a governance framework to harmonize tax collection across all tiers of government. It also introduces a Tax Appeal Tribunal and an Office of the Tax Ombudsman to protect taxpayer rights and resolve disputes.

Analysts have hailed the scrapping of FIRS as a bold and necessary step, one expected to boost investor confidence, increase revenue, and reduce the burden on taxpayers.

State House officials emphasized that the reforms are a central pillar in President Tinubu’s broader economic stabilization and growth agenda. The shift from FIRS to NRS, they noted, is not merely a name change but a complete institutional transformation aligned with global best practices.