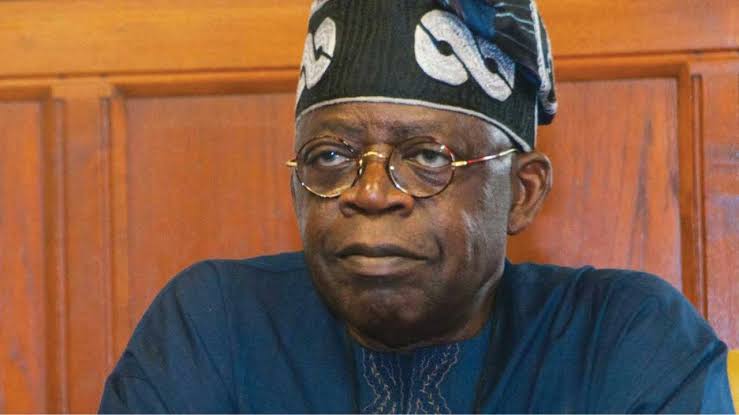

Tinubunomics: An Insight into Nigeria’s Remarkable Economic Consolidation, by Daniel Bwala

President Bola Tinubu will clock two years in office by the end of next month. This is perhaps one of the longest and most consequential two years in Nigeria’s peacetime history. From that fateful day on May 29, 2023 that President Bola Tinubu launched Tinubunomics at the Eagle Square, Nigeria has been undergoing a long needed structural reforms on every facet. I will attempt to chronicle some of these as concisely as possible.

The Nigerian Picture pre-May 29, 2023

Prior to May 29, 2023, Nigeria, unknown to many of its citizens, was sitting precariously on the edge of a high cliff. A cliff that was gradually built due to our reluctance as a country to ditch many unsustainable practices and face our stark realities boldly. The Nigerian federation was increasingly drowning under the yoke of multiple subsidies including fuel subsidy, naira subsidy, electricity subsidy and many other tangible and intangible subsidies across different sectors of the economy.

These subsidies dug a deep hole in our treasury and we often had to borrow to sustain them. This meant that as at June 2023, Nigeria was expending 97% of its revenue to service debts. NNPC Ltd was taking huge losses to continue subsidising PMS, the CBN was undergoing chronic haemorrhage and had around $7 billion backlog of unsettled FX obligations hanging around its neck while struggling to maintain the Naira at a grossly undervalued rate, which encouraged rent-seeking.

Nigeria’s Economic Picture under Tinubunomics

President Bola Tinubu took very unpopular but drastic steps when he affirmed removal of fuel subsidy and liberalisation of the foreign exchange market to allow interplay of market forces to determine the exchange rate. This twin landmark decisions expectedly spiked inflation with food inflation being the major driver. Nigerians had to endure a severe escalation in the cost of living and even some companies including multinational entities suffered some discomforts. The initial economic headwind was severe but President Bola Tinubu, being a determined captain, stayed the course and braced the storm.

Nature, they say, favours the brave and the resilient. Tinubu’s brave navigation of the economic turmoil that came with the subsidy removal and FX liberalisation began to yield undeniable fruits in the latter part of 2024. These fruits include:

1. Drastic increase in domestic crude refining capacity: Following the removal of PMS subsidy, the Dangote Refinery and the government-owned Port Harcourt refinery were able to confidently begin PMS production, knowing that they would sell their products based on the prevailing market price. The President facilitated a deal to enable refiners like Dangote obtain domestic crude oil priced in Naira.

Thanks to the competition now in the deregulated oil sector, price of PMS, which was sold at over N1200 per litre in late 2024 has steadily reduced to an average of N890 per litre and is expected to further reduce if current crude oil prices persist. Petroleum product scarcity is now history with hoarding or snuggling of products to Nigeria’s neighbouring countries now very unattractive.

2. Stabilisation in cost of living: In the heat of the economic storm that followed the fuel subsidy removal and the liberalisation of the Naira, prices of goods and services, especially food items were increasing almost hourly. This drove food inflation rate to more than 40% far above the average monthly headline inflation which nestled at 34.8% as at December 2024 before a rebasing of the Consumer Price Index (CPI) was carried out by the NBS.

However, as PMS price continued to decline as well as increased adoption of the cheaper alternative CNG, food inflation began to ease with very significant reduction in the price of popular staple food items noticed across the country. The decision of the Tinubu administration to open a 150-day duty-free window in July, 2024 for essential food imports, including maize, husked brown rice, and wheat, as part of the Presidential Accelerated Stabilisation Advancement Plan also contributed in stabilising food prices once the food items began to arrive in Nigeria’s ports.

It is instructive to also add that improved security across many agrarian communities especially in the North West where farmers initially abandoned their farms due to pervasive banditry returned to their farms following monumental offensive by the military against bandits. Grain Markets in bandit hotbeds like Birnin Gwari reopened with farmers flooding the market with their harvests. In the first quarter of 2025, almost all food stuffs witnessed price reduction.

3. Record Inflow of Revenue to the three tiers of government: Following the bold move to end fuel subsidy and stop the arbitrary pegging of the Naira, the revenue available to the federation account for sharing by the three tiers of government more than doubled with many states seeing their FAAC revenues almost tripling. This increase is despite the fact that a chunk of the revenue accruing into the federation account are not always distributed but saved. This revenue windfall has made many states to reduce their appetite for commercial loans. More revenue in the hands of the three tiers of government means more investment in infrastructure and social services for the people.

4. Nigeria becoming a favourite destination for foreign investors: Following a string of monetary reforms embarked upon by the Central Bank of Nigeria with the full support of the President, the monetary ecosystem of Nigeria has witnessed a new lease of life. The CBN has decluttered the monetary swamp hitherto encumbered by many bottlenecks and unwholesome practices, which often scared investors away from Nigeria’s financial sector. The sanitisation of the foreign exchange market by the CBN has made naira largely free from destructive speculation with restrictions on FX transactions now history.

As a result of these reforms, Nigeria’s sovereign risk spread has fallen to the lowest level since January 2020. This improvement is demonstrated in Nigeria’s latest Eurobond issuance in December where the $1.7 billion issuance was subscribed four times more than the offer Nigeria intended. The Eurobond issuance, which clocked over $9 billion in orders, clearly shows the strong investor confidence in Nigeria’s economy. To cap it off, Fitch Ratings upgraded Nigeria’s outlook to Stable from Negative and maintained Nigeria’s long-term foreign currency rating at ‘B’.

5. Nigeria’s economy witnessing massive trade surplus: Thanks to the bold decisions of the Tinubu administration, Nigeria is now witnessing a significant trade surplus. In 2024, Nigeria recorded a total trade volume of N138 trillion, the highest in our country’s history. This figure represents a 106% increase compared to that of 2023. In dollar terms, this translates to $89.9 billion. Despite the huge depreciation in the value of the Naira recorded in 2024 compared to 2023, this volume of trade shows that Nigeria’s trade volume surged by 22.1% in 2024 when dollarized.

Nigeria exported goods worth N77.4 trillion in 2024 compared to the N35.96 trillion it exported in 2023. This rise in export following a challenging 2023 indicates that the reforms instituted by President Bola Tinubu is yielding immediate fruits especially in the area of petroleum exports, which formed 71% of our total export in 2024. The concerted efforts of the military with the full backing of the President to tackle crude oil theft in the Niger Delta led to Nigeria’s average crude oil production (excluding condensate) rising to over 1.5 million barrels per day.

With an import of N60.6 trillion in 2024, it means Nigeria’s balance of trade stood at N18.86 trillion in 2024, up from the N6.09 trillion recorded in 2023. This is a sign that the Nigerian economy is beginning to roar back to life.

6. Nigeria’s Net Reserves surge: Nigeria’s foreign reserves has also witnessed a significant consolidation since President Bola Tinubu came on board. Despite clearing at least more than $5 billion in verified inherited FX backlog last year, the CBN was able to oversee an accretion in Nigeria’s gross foreign reserves from $35.09 billion on May 30, 2023 to over $40.19 billion in December 2024. The difference is just $5.1 billion over a span of 18 months. The reduction in the gross external reserve noticed in the first quarter of 2025 is as result of settlement of many debt obligations that are due including a $1.1 billion Eurobond repayment.

As impressive as this movement in the gross external foreign reserves is, considering what the CBN had to pass through to achieve that, the above picture does not tell the whole story. The Net Foreign Exchange Reserves (NFER) tells a better story of our precarious situation back in 2023. As at end of 2023, Nigeria’s Net Foreign Exchange Reserves was just a mere $3.99 billion. Less than two later, the NFER has climbed to $23.11 billion. The NFER adjusts gross reserves by accounting for near-term liabilities such as FX swaps and forward contracts to give a picture of the actual forex available to meet immediate external obligations.

7. Reduced Budget Deficit: The fruits of President Tinubu’s many reforms is also seen on the fiscal side with a marked reduction in Nigeria’s budget deficit despite a historic spike in the total budget sum. In 2025, budget deficit is 4.17% down from 6.2% recorded in 2023. In fact, the ratio of the 2025 budget deficit to GDP is 3.89%, which is lower than the average 5% before now. What this means is that, even though the budget deficit will be financed through borrowing, the amount government would borrow in 2025 is less than before relative to the GDP. This signals an intention by the Tinubu administration to be more financially prudent and gradually move away from borrowing over time.

8. Nigeria recording increased investment inflows and companies profitability: Over the past 12 months, Nigeria has been witnessing increased inflow of investments into many sectors of the economy including the oil and gas sector, financial sector, manufacturing and solid minerals. As a result of the deliberate reforms instituted by the President to remove bottlenecks in the oil and gas sector and incentivize investment, Nigeria in 2024 alone has received $13.5 billion in Final Investment Decisions (FIDs) from global oil and gas companies only. This represents 75% of FIDs announced across the African continent. Beyond oil and gas, the solid mineral sector is always witnessing inflow of serious investment in value addition to lucrative solid minerals.

In the manufacturing sector, a lot of greenfield investments are also flowing into with some existing companies announcing expansion in their operations. Already a lot of manufacturing firms have posted record profits in the preceding financial year. Financial institutions are declaring record gross profit, with the capital market having a sustained bullish run. All these indicate one thing – solid confidence in Nigeria’s economy, and of course in Tinubunomics!

— Dr. Daniel Bwala is the Special Adviser to President Bola Ahmed Tinubu on Media and Policy Communication