ABCON: Forex Reforms Can Achieve 1500/$

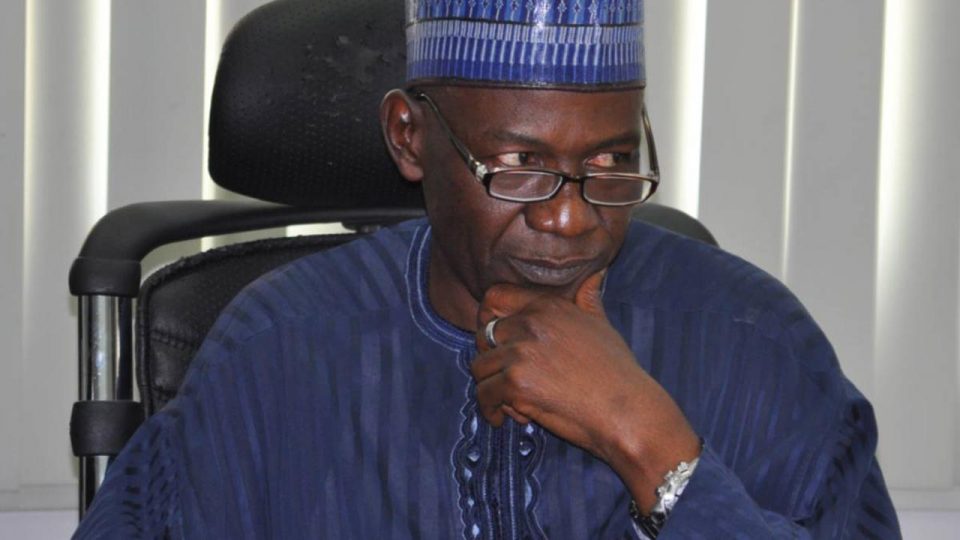

According to Aminu Gwadebe, the President of the Association of Bureau De Change of Nigeria (ABCON), has said that the 1500/$ peg in the 2025 Appropriation Bill was within reach on the back of recent foreign exchange reforms being pushed by the Central Bank of Nigeria.

Gwadebe said this on Tuesday in a chat with The PUNCH about the strengthening of the naira amid the festivities.

According to the FMDQ forex close, the naira appreciated to N1,539.55/$ on Monday from N1,541.7/$ last Friday.

At the parallel market, BDC operators in the Yaba area of Lagos quoted the naira at 1650/$ on Tuesday.

Speaking on the trend, Gwadebe said, “The naira is stabilising and steadily appreciating. It is around N1650/$; buying is lower than that.

“The Electronic Foreign Exchange Matching System is about transparency, and if you don’t forget, the CBN has intervened many times to keep liquidity in that market, and now they have also issued a circular lifting the suspension on sales of interbank FX to BDCs by the banks. Structures are being put in place to ensure the take-off. As soon as that is completed. I’m sure it will also help the retail end, and we will begin to see the achieved target of N1500/$ being estimated in the 2025 budget.”

The CBN’s EFEMs went live at the beginning of the month to boost the operational efficiency and transparency of the nation’s FX market.

Also, this month, the CBN granted BDC operators temporary permission to purchase up to $25,000 weekly in foreign exchange from the Nigerian Foreign Exchange Market.

This move, detailed in a circular dated December 19, 2024, is designed to meet seasonal retail demand for FX during the holiday period.

The circular signed by the acting Director, CBN Trade and Exchange Department, T.G. Allu, partly read, “In order to meet expected seasonal demand for foreign exchange, the CBN is allowing temporary access for all existing BDCs to the NFEM for the purchase of FX from authorised dealers, subject to a weekly cap of USD 25,000.00 (Twenty-five thousand dollars only).

This window will be open between December 19, 2024, and January 30, 2025.

“BDC operators can purchase FX under this arrangement from only one Authorised Dealer of their choice and will be required to fully fund their account before accessing the market at the prevailing NFEM rate. All transactions with BDCs should be reported to the Trade and Exchange department, and a maximum spread of one per cent is allowed on the pricing offered by BDCs to retail end-users.

“The general public is also reminded of the continued availability of PTA/BTA from their banks to meet their personal and business travel requirements and that all legitimate and eligible foreign exchange transactions are expected to be completed. In the NFEM, at the market-determined exchange rate.”

Recall that the exchange rate in the 2025 Appropriation Bill had been reviewed upward to 1500/$ from 1400/$ indicated in the Medium Term Expenditure Framework released in November.

The MTEF, which was released by the Budget Office, had pegged the exchange rate at 1400/$, oil crude oil production projected to increase to 2.12 million barrels per day in 2025, and a benchmark crude oil price of US$75 per barrel.

Also, the inflation rate was projected to decline from an average of 27.85 per cent in 2024 to 16.94 per cent in 2025.

However, President Bola Tinubu, during his budget presentation speech last Wednesday, said the proposed budget was based on the projections that inflation will decline from the current rate of 34.6 per cent to 15 per cent next year, while the exchange rate will improve from approximately 1,700 naira per US dollar to 1,500 naira and a base crude oil production assumption of 2.06 million barrels per day.

SOURCE: The PUNCH