Between e-Naira and Health Insurance in Nigeria, by Abdulrahman Abdulraheem

With an estimated population of 215 million people, the highest in Africa, experts believe Nigeria’s healthcare numbers do not add up especially considering the population and land mass.

Among the West African countries, Nigeria has the second highest density of medical doctors, which is, however, still very low compared to the actual need for such a large and populous nation.

One of the major health threats in Nigeria is malaria. According to the World Health Organisation (WHO), malaria is the main cause of maternal mortality and poor child development. Both issues represent critical realities in Nigeria and other West African countries.

Maternal mortality in Nigeria is the third highest in the whole continent, with over 900 deaths per 100,000 live births. Child malnutrition and infant mortality are worse. Mortality rate for infants and children under five years is 70 and 104 per 1000 live births respectively.

Life expectancy ratio for both male and female is less than 60 years.

Vaccine-preventable diseases like measles, meningitis, poliomyelitis and others have not been completely eradicated.

Government expenditure on health is considerably slimmer than what comes from private contributions. According to a recent study, only about three percent of Nigeria’s GDP is invested in the health sector.

Nigerians therefore usually have to pay for health care out of their own pocket. Often, the medicine is expensive and difficult to afford, yet poverty is a big issue.

In 2018, the World Poverty Clock turned and Nigeria became the World’s Poverty Capital with over 100 million of it’s population living below the poverty line. Funding for health care services or health care affordability has therefore been a huge problem for the average Nigerian family.

Highlights of the 2022 Nigeria Bureau of Statistics (NBS) Multidimensional Poverty Index (MPI) survey revealed that 63% of persons living within Nigeria (133 million people) are multidimensionally poor. The National MPI is 0.257, indicating that poor people in Nigeria experience just over one-quarter of all possible deprivations.

Unfortunately, the results of a governmental survey show that about 97 percent of Nigerians did not have any health insurance in 2018. People with health insurance mainly had employer-based coverage, whereas privately purchased insurance was uncommon.

e-Naira to the Rescue

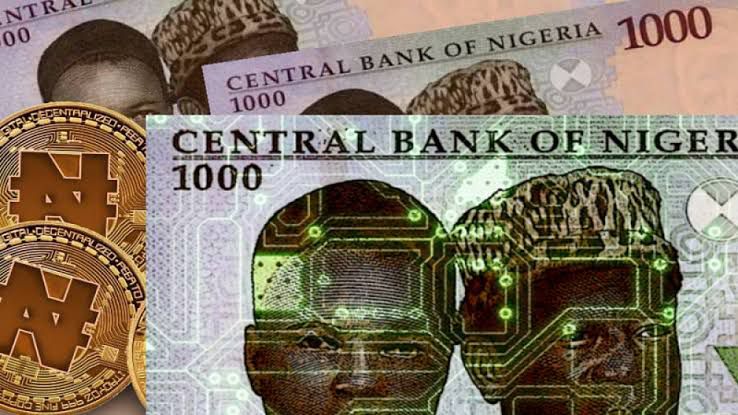

When President Muhammadu Buhari launched the e-Naira in October 2021, the Central Bank of Nigeria (CBN) governor, Godwin Emefiele, informed Nigerians that it was groundbreaking effort to move Nigeria into digital currency with its countless benefits.

Emefiele said the e-Naira will have the same value and function of the traditional naira as a medium of exchange and a store of value. He added that the e-Naira has the advantage of being easier, faster and cheaper to operate and transact business with.

Emefiele didn’t however inform Nigerians that the e-Naira is what traditional or herbal medicine hawkers call “Gbo Gbo Nise” which means a drug that can do all things, cure all ailments and solve all problems. And that is evolution and the power of innovation for you, the genius of the Nigerian youth, the can-do spirit in every Nigerian.

First, Emefiele has to take the credit for the vision on e-Naira, for making Nigeria the first country in Africa to officially embrace digital currency and one of the first countries in the world to do so. Emefiele may be the most criticised government official today but when he leaves office, Nigerians would look at what e-Naira is doing in their lives and remember him for good. This is because the e-Naira idea may as well be the greatest legacy of his rather eventful, if not controversial, tenure as the apex bank boss.

Having done the launch and laid a a solid foundation, a lot of Nigerians are now coming up with different ideas and products that can expand the use of the e-Naira platform. Over the years, ideas have never been the problem of Nigerian youths, its the enabling environment and the infrastructure needed to express themselves and display their talents that have been lacking. Now that Emefiele has created one, a lot of ideas are at different incubation stages to ensure the e-Naira is that platform that Nigerians can build their lives around.

One of those private geniuses inspired by Emefiele’s transformative vision is working on a product on e-Naira platform to help poor Nigerians access quality health services without paying through their noses.

This is part of measures meant to drive home the e-Naira message to all and sundry, that it is a comprehensive package that is capable of not only easing transactions but also solving most of the day to day problems of the average Nigerian.

I had a privilege to sit with the CBN’s Director of Information Technology, Mrs Rakiya Muhammad, in her office recently, and she told me that since the e-Naira was launched in October 2021, there have been a lot of private initiatives meant to expand the scope of the digital currency and add some products that can help Nigerians live more abundant lifes.

The Director told Economic Confidential that the apex bank has been encouraging the private initiatives to blossom in view of the limitless opportunities abound in the e-Naira platform which include cheaper, more efficient, faster transactions with no bank charges, network problems and other bottlenecks associated with regular banking.

She hinted that someone was working on a product that will, in collaboration with some Health Management Organisations (HMOs), help Nigerians to be saving money on a regular basis on their e-Naira wallets which they can use to access healthcare in case of any medical emergency or necessity.

“So, on the other product, she has a way to help Nigerians save money towards health insurance. So, they partner with all these HMOs and others and you can use e-Naira to be saving little amount of money everyday and when you go to the hospital, you can now use that to pay for health insurance. It will solve the problem of all those people who will go to the hospital, without the money, cash or card to pay. You already have insurance with your e-Naira. A very very interesting product.

“So, all those people are going through our incubation process. We are connecting them with investors and we have seen the huge progress they are making. It will come live soon,” she said.

These are indeed exciting times for Nigerians. The product on health insurance is just one out of countless ones coming up and they are meant to make browsing through the e-Naira platform a remarkably rewarding experience for everyone.

When the product is eventually launched, there won’t be any surprise if the country’s health care numbers improve over time.

Abdulrahman Abdulraheem is Managing Editor Economic Confidential [email protected]