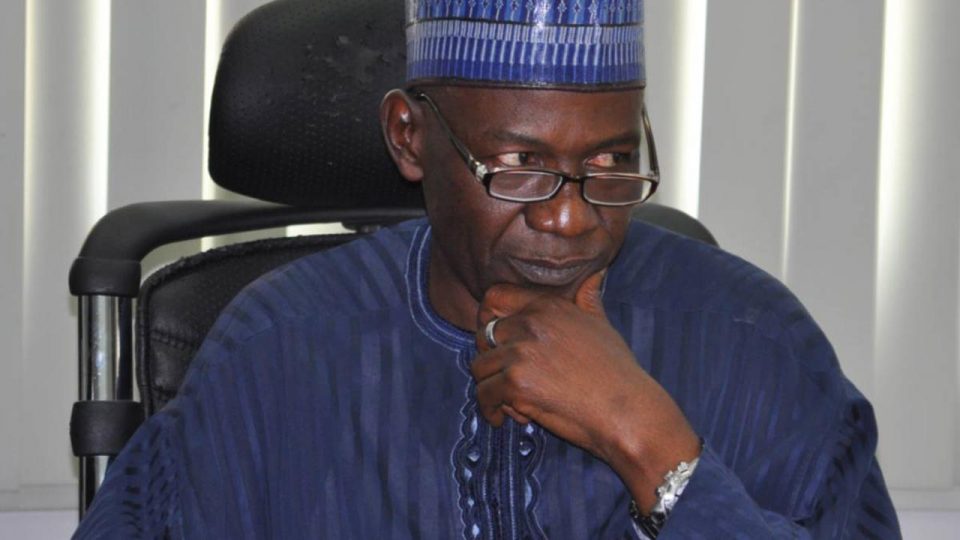

Exchange Rate Unification’ll Promote Transparency In Forex Market – Gwadabe

Plans by the Federal Government to unify the naira exchange rates will bring out improved resource allocation, better competition and transparency in the foreign exchange market, President, Association of bureaux De Change Operators of Nigeria (ABCON), Ahaji Aminu Gwadabe has said.

Speaking with financial journalists in Lagos, he said unification of exchange rates will promote exchange rate stability and tackle rate spikes in the market. “It will usher in a competition, better resource allocation and transparency in the market. The Central Bank of Nigeria tried it before in 2017 with the introduction of the Investors’ and & Exporters Forex window to enhance liquidity in the market.

The Bureaux De Change (BDCs) are the only monetary instruments of the CBN to achieve unification of exchange rate as their service is critical for retail end users of the foreign exchange market,” he said.

He said making BDCs agents of International Money Transfer Operators (IMTOs) will help attract more dollars to the economy and promoting inflow of diaspora remittances.

Gwadabe said ABCON has been working with industry consultants in designing and developing a robust automation and deployment of technology that will enable BDCs fit into the IMTOs role in deepening dollar liquidity in the economy. He added that removing foreign exchange restrictions is also likely to lower income inequality. It helps facilitate more effective ways of protecting consumers through social safety nets.

He said that unifying the exchange rates now will be in accordance with the Economic Recovery and Growth Plans -ERGP’s goal of supporting Nigeria’s economy. It will be most effective as part of a wider policy package, with measures that include a focus on revenue mobilisation to make room for priority spending, tight and transparent monetary policies, a resilient banking sector and structural reforms.

He said Nigeria’s long-term economic potential will be improved significantly with exchange rate unification as it removes distortions, provides greater clarity to economic operators and a level playing field. It also needs to be backed by strengthening banking sector resilience, and structural reforms and giving more critical roles to BDCs, which have demonstrated diligence and strength in ensuring that dollar is available at the retail end of the market.

Gwadabe disclosed that BDCs have supported dollar inflows to the economy, including the inflow of over $25 billion diaspora remittances, which has come to represent higher dollar receipt than crude oil sale.

He said the unification of the exchange rate will help in increasing market liquidity, discourages speculation and hoarding. It will also lead to ease of regulatory supervision, transparency and effective price discoveries as well as deepening market perfections.

He said unified exchange rate will also help to curb rising inflation, which rose to 12.4 per cent year-on-year in May continued has surged in recent months as the impact of the Covid-19 pandemic reflected on the economy.

The May inflation rate was 0.06 percent points higher than the rate recorded in April 2020 (12.34) percent. On month-on-month basis, the Headline index increased by 1.17 per cent in May 2020, this is 0.15 percent rate higher than the rate recorded in April 2020 (1.02) per cent.

The ABCON boss said it was encouraging by the level of progress already made by Nigerian authorities towards unifying the exchange rate windows.

Global trends suggest that countries with multiple exchange rates struggle to see their economic growth recover and trade pick-up after a crisis. Countries with multiple exchange rates on average also experience higher inflation. With lowering inflation and boosting growth as focal points for Nigeria, unification of the exchange rate can bring major gains.