The Wapic Insurance Plc, has unveiled five new insurance products to meet the unique lifestyles of Nigerians.

The Wapic Insurance Plc, has unveiled five new insurance products to meet the unique lifestyles of Nigerians.

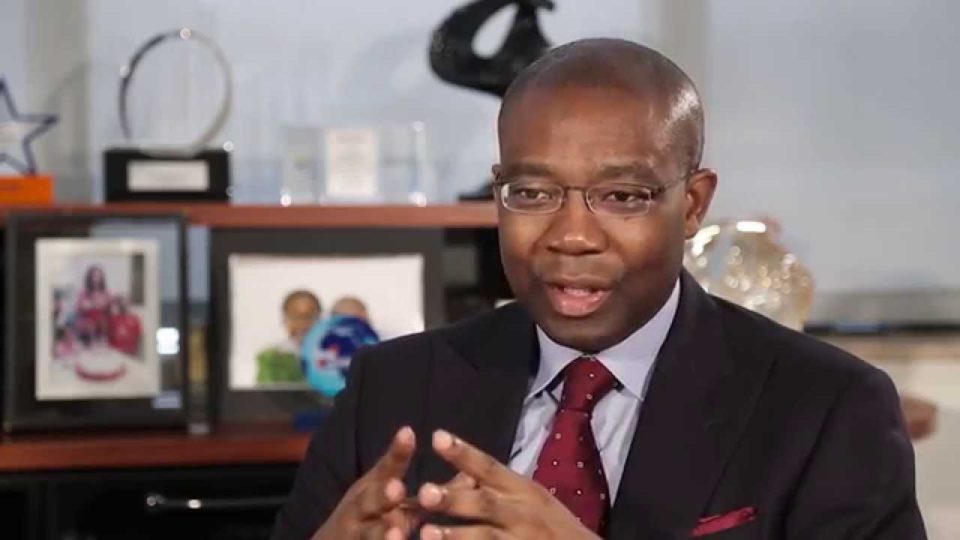

The products that are classified under Wapic Smart Investment-linked Products are to cater for the protection and goal oriented needs of individuals, families and businesses according to Rantimi Ogunleye, the Managing Director of Wapic Assurance Life Ltd.

The products are the Smart Life plan, Smart Life+ plan, Smart Scholar plan, Smart Senior plan and the Smart Wealth plan.

“These plans come with the dual appeal of flexibility and convenience, focusing mainly on the family, education, retirement, short and medium term plans,’’ he said.

Ogunleye said Wapic Smart Life+Plan was a unique product designed to help individuals attain their goals and targets with added advantages.

“It is an insurance solution that provides you the opportunity of systematically accumulating funds towards meeting short term obligations and emergencies.

“It also guarantees the policy holder a more competitive interest rate, withdrawals without being penalised and a free life insurance cover,’’ he said.

He said the Wapic Smart Scholars Plan was an insurance solution that provides the opportunity to save funds towards financing the children’s education

“The product also offers embedded insurance protection against the risk of demise and permanent disability on the life of either or both parents.

“It guarantees payment of the school fees whether or not the parents are alive, subject to the limit of a chosen targeted sum.

“The policy is written in the name of the child and provides a medical expense cover for the child as a result of accident while in school.

“It also provides a cash award for the child if he or she is the best in the class,’’ Ogunleye said.

According to him, Wapic Smart Seniors Plan is an insurance solution that provides the opportunity to save funds towards retirement with an embedded insurance cover.

“It offers the policy holder highly competitive interest rates, free critical illness benefit, 200 per cent of the sum assured as permanent disability benefit.

“In the event of demise, it offers the sum assured together with the account balance,’’ he said.

Ogunleye said the Wapic Smart Wealth Plan was an insurance solution that offers an opportunity of investment and embedded insurance protection against the risks of demise and critical illness.

“The insurance premium is deducted within the period of investment but insurance covers throughout lifetime even when you have taken the maturity proceeds.’’

Also speaking on the occasion, Mrs Yinka Adekoya, the Managing Director of Wapic Insurance Plc, stated that “it is difficult to make progress without plans and goals’’.

“For us at Wapic, we know that a good insurance plan is key to achieving successful living and so we have developed a variety of insurance solutions to address critical customer needs,” Adekoya said.

Recall that Wapic Insurance Plc is West African multi-line insurance company, providing solutions covering life, general and special risks

The organisation was established in 1958 and and was listed on the Nigerian Stock Exchange since 1978.

Its mission is to transform into a diversified financial services institution, delivering value in a sustainable manner to its customers and stakeholders.