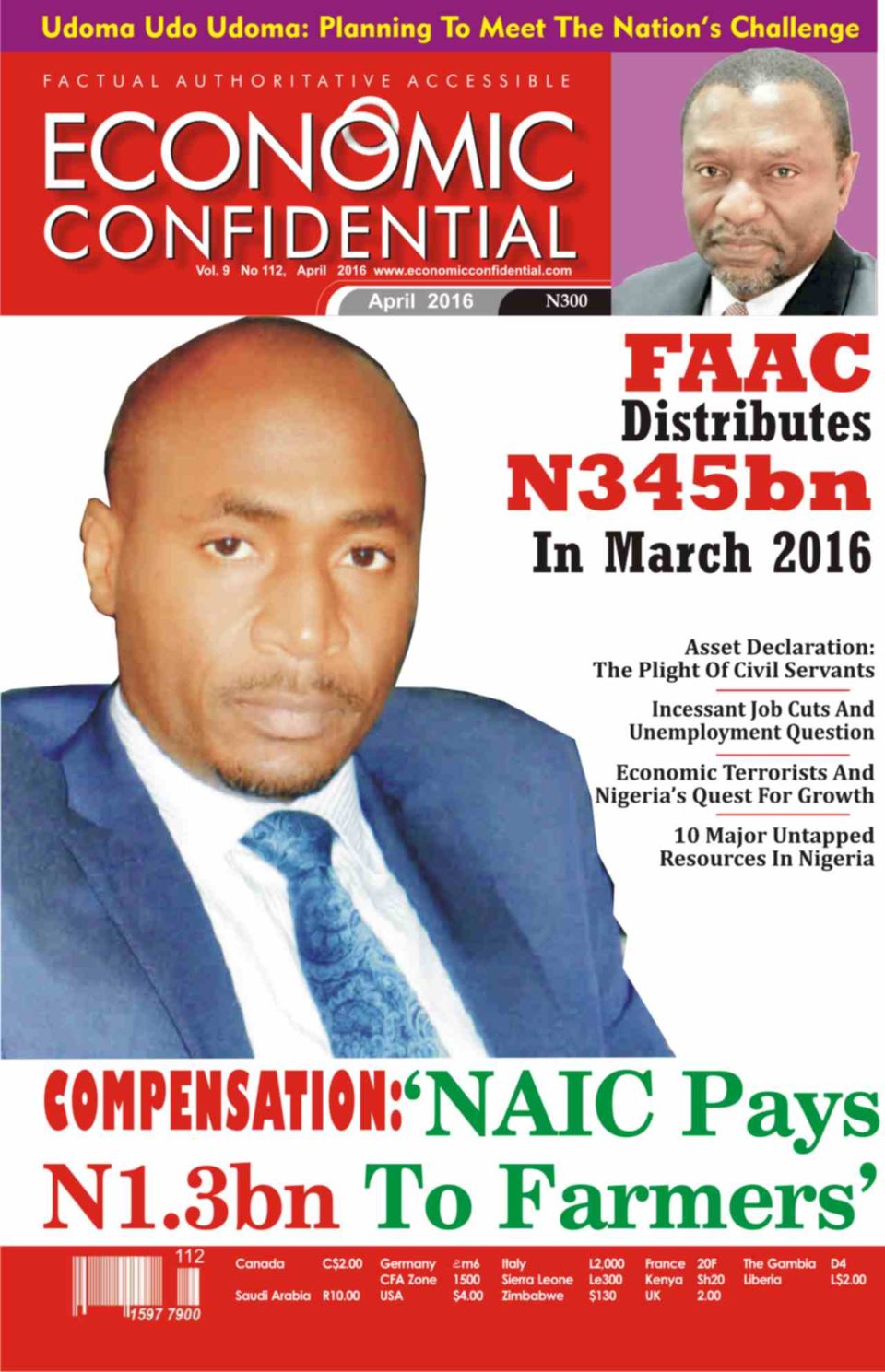

Who is Bashir Binji?

Mr. Binji hails from Sokoto State and until his appointment was the Executive Director (Operations) of the Corporation. But before joining the corporation as Executive Director, Binji was the Zonal Head, North of Zenith Insurance between 2006-2015 and has worked with the Technical Division of Nigeria Re-Insurance Corporation.

Binji is a graduate of Usman Danfodio University Sokoto, with Bachelor of Science Degree in Management Studies. He is an Associate of Chartered Insurance Institute of London.

He also holds an MBA degree from Ahmadu Bello Univeristy Zaria, Diploma in Insurance with distinction from the West African Insurance Institute (WAII) Banjul, Gambia, and Advanced Diploma in Insurance in London, He has attended many courses both locally and internationally, and has over 18 years cognate experience in the insurance industry.

Why Agric Insurance and what role does Nigeria Agricultural Insurance Corporation (NAIC) play in Nigeria’s food security and diversification of the economy?

The Federal Government established NAIC in order reduce or minimize the risky nature of agricultural business by the evolution of a shock absorbing mechanism that would assure reasonable returns to farm investors and institutional lenders. The main role of NAIC is to offer protection to farmers from effects of natural disasters and to ensure payment of appropriate compensation sufficient to keep the farmer in business after suffering loss or losses. There are other significant roles that NAIC play and they include but not limited to the facilitation of the flow of credit to farmers through the provision of suitable guarantee or security for lending agents, increased agricultural production and food security by eliminating the need for ad-hoc assistance provided by government during agricultural disasters.

What Insurance covers do you provide to farmers and other investors in Agriculture?

NAIC’s agricultural insurance covers are divided into two main categories: Crop insurance, livestock (including poultry and fisheries) insurance. In the case of crops, the policy offers a wide range of natural, climatic and biological perils including fire, drought, flood, windstorm and pests and diseases, while the livestock policy covers the death or injury due to accident, disease, fire, lightening, storm and flood. Furthermore, the Corporation provides cover for farm produce against fire, burglary and transit risks.

Apart from Agric Insurance, does NAIC underwrite policies in general insurance business?

Yes. The Corporation was granted the operational license by the insurance regulatory body in Nigeria – National Insurance Commission (NAICOM) to underwrite various types of risks associated with general business, along commercial lines at competitive premium rates.

What has been the response of NAIC’s clientele to its service delivery over the years?

The responses of our clientele to our services over the years have so far been positive. This is because of the promptness of the payments of claims which is based on a clear, transparent and objective criteria.

Furthermore, complimentary to our various policy offerings, is free farm management advisory provided by our highly trained professionals to farmers during the period of cover thereby reducing the incidences of losses.

Finally our insurance products and services are acknowledged all over the world as one the best as it provide cover for a multiple range of perils under a single insurance cover.

Is NAIC adequately capitalized and equipped in terms of personnel to widen its scope of operations?

The Corporation is adequately capitalized financially to meet up with its various financial obligations to both its internal and external customers. Before NAIC was granted its operational license by NAICOM to underwrite the general insurance business line, it has to meet up with the appropriate regulatory requirements in terms of capital adequacy. The Corporation has in its fold, a myriad of highly skilled, competent and experienced technical personnel that has the competency to expand its scope of operations. This personnel cut across many professions such as Insurance, Animal science, Veterinary Doctors, Plant anatomists etc.

How prompt are claims settlements in NAIC?

NAIC takes the issue of prompt settlement of claims seriously. Properly documented and verified claims are settled within a maximum of 5 working days timeline. The Corporation recognizes the fact that most agricultural projects are time bound; therefore the need arises to settle claims as promptly as possible to ensure that the farmers return to farming as soon as possible. Furthermore, the greatest marketing tool of agricultural insurance is the prompt settlement of claim.

Generally speaking, what aspect of subsidy does NAIC offer to farmers?

The Corporation offers a premium subsidy (rebate) of 50% farmers involved in food crops production and livestock insurance, This subsidy is shared btw federal and respective state where the farm is located in proportion of 37.5% and 12.5% respectively.

Who can take NAIC cover?

All categories of farmers be it small, medium or large scale can subscribe to NAIC insurance cover. It is a fact that the majority of our clientele are small scale/micro farmers that have their projects sponsored by financial institutions or government interventions in form of loans, credit and guarantees and the insurances of these projects are compulsory in line with extant regulations.

How much has NAIC paid so far to farmers who incur losses?

In The Last Four Years, Naic Has Paid About N1.3 Billion To Farmers Involved In Various Types Of Agricultural Losses And Generated Premium Of N4.5 Billion.