Minerals are essential for modern day living and mining is still the primary method of their extraction. Organized mining in Nigeria began as early as 1903 under the British colonial government. And by the 1940s, the country had become a major producer of tin, columbite, and coal. The breakout of the civil war in 1967 truncated further growth the sector as expatriates left , the oil boom came and since then, mining was never the same again. For instance, coal mining in Enugu was affected and despite the fact the country has the best kind of coal (low sulphur and moderate ask content) the pre-war gains have not be replicated.

Mining in Nigeria is at low ebb despite all the vast resources lying underneath’s the country’s surface. Not much has been done to harness these nature’s gifts to diversify the economy and earn much needed income for the nation beyond crude oil sales. Ironically, considering the importance of mining as a catalyst that affect other sectors including the much sought after industrialization, agriculture, telecommunications which can boost economic growth it would be expected that more efforts should have been put into ensuring it is a viable sector. Unfortunately, after decades of mining operations in Nigeria, the Nigerian mining industry is still at the scratching level, without mechanized operations.

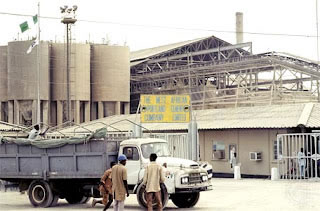

The mining industry brings little to the table, as the most actively mined mineral in the country (at the moment) is limestone. This has made the nation a dumping ground where things that can be manufactured are rather imported. There are about thirty-four [34] minerals that have been identified in the country, of which only 13 are being actually mined, processed and marketed. They are coal (which has an export potential of 15 million tonnes per annum valued at US$1billion), kaolin, baryte, limestone, dolomite, feldspar, glass sand, ganstones [haphazard], gold [in small quantities], iron ore, lead-zinc, tin and its associated minerals and recently gypsum. The remaining twenty-one [21] minerals, though in demand are untapped; the volumes of domestic trade deficit and foreign exchange losses resulting from this deficiency are colossal. Coal, for instance is a major player in the world’s energy mix. It makes up over 23% of the energy consumed in the world and it is used to generate over 40% of the world’s electricity and the country is still experiencing insufficient power supply!!

Lack of political will to pay attention and focus on mining has been one of the factors mitigating against the growth of this sector as subsequent administrations, despite steps taken, such as the creation of the Ministry of Mines and Steels in 1995 and Nigerian Extractive Industries Transparency Initiative (NEIT) inaugurated in 2004.

However, having neglected the once lucrative sector for the past few decades, the Nigerian government under the Obasanjo and Jonathan administrations appears willing to revive the mining industry as investors are being sought for 34 different types of minerals – including iron ore, coal, barite, gold, uranium and copper – found in commercial deposits at 450 sites scattered across the country. This is a build up on the stimulus provided by foreign institutions and governments. For instance in 2004, the World Bank committed $120 million to help establish the Sustainable Management of Minerals Resources Project (SMMRP) to support mines and steel development in Nigeria. The support would help identify mineral resource corridors, improve education and training for mining sector employment, and update the fiscal regime for mining.

Meanwhile, the government had also tried to create a regulatory environment attractive to foreign investors, such as loosening regulation and taxation policies through the 2007 Minerals and Mining Act. This Act reduced government participation in the mineral sectors to the role of “administrator-regulator”, and allows exploration and mining licenses to be held in full by foreign companies. It also provided a more favourable taxation regime to foreign mining companies, made royalty payments relatively low — less than 5% — and Nigeria’s corporate tax rate was a competitive 35% of net profit, with mining companies exempted from all other local taxes. As part of the ongoing reform programme, the Ministry of Mines and Steel Development (MMSD) was also divesting its ownership in the sector. Despite that, there has been no marked improvement in the sector as the steps should have opened up more room for expansion.

In June 2013, Nigeria’s Minister for Mines and Steel Musa Mohammed Sada said in an interview with Reuters that Nigeria was aiming to increase mining’s contribution to the economy to 5% by 2015, from its current level of 0.5% – a tenfold increase. And amidst a raft of new legislation and push towards privatisation, the mining sector can also expect to benefit from the financial and technical support of developmental partners such as the World Bank.

The Jonathan administration in August 2013 signed a Memorandum of Understanding with HTG-Pacific Energy Consortium for the development of Ezinmo Coal Bricks and a 1000 megawatts coal power generating plant of $3.7billion. The Zuma coal mining site, located in Okobo/ Enejema Communities in Ankpa Local Government Area of Kogi State is also expected to provide 1000MW of electricity.

However, while economic deregulation may be useful for attracting investors, Nigerian mining also calls out for much enhanced regulation of the health and safety kind. Indeed, regulatory deficiencies and the dangers of small-scale, unsupervised mining still plague the Nigerian mining sector.

Environmental issues such as erosion, sinkholes, loss of biodiversity, contamination of soil, water, and air and land pollution have to be prevented or reduced to the barest minimum as these can cause damage to the environment, and by extension, the health of the people in surrounding areas. Mining companies must follow stringent environmental and rehabilitation codes in order to minimize environmental impact and avoid impacting human health.

Mining has multiplier effect. For instance in the United States, mining directly and indirectly generated just over 1.9 million full-time and part-time jobs in 2012, including employees and the self-employed; with the coal sector accounting for 708,140 jobs, $47.1 billion in labour income and $83.2 billion in contribution to GDP . The metal ore mining segment of U.S. mining accounted for 348,450 jobs, $22.9 billion in labour compensation and $56.3 billion of GDP. The non-metallic mineral mining segment of U.S. mining accounted for 846,850 jobs, $48.2 billion in labour compensation and $86 billion of U.S. GDP.

Mining activity generated $28 billion in federal taxes and another $18 billion in state and local taxes, for a total of $46 billion in 2012. If this sector were to fully run, it is certain that apart from the level of unemployment in the country seeing reduction, especially in rural areas where the minerals are mined, and the country’s earnings increasing, mined products will be exported and also used in domestic industries for generation of foreign exchange and internal revenue; there will be emergence of new industrial and downstream products; technology transfer and development of infrastructure, most especially sustainable means of transportation like the railway system, good roads, hospitals, housing and schools particularly in the rural areas too. The solid minerals sector can very easily be the largest employment sector of the economy, since deposits abound in virtually every state.

Furthermore, The Nigerian Export Promotion must also be funded and collaborate well with the private sector in order that it can be a bridge between producers and buyers, promote exportable products to the international community. This can further boost the confidence of investors to bring in much needed technical know-how, funding and equipment so as to add value and increase production.

The government’s major duty here is to create a conducive environment, formulate the policy while the private sector drives the economy.