National Bureau of Statistics has released GDP estimates for January 2012 to September 2013. On an aggregate basis, the economy when measured by the Real Gross Domestic Product (GDP), grew by 6.81 percent in the third quarter of 2013. This was higher than the 6.18 percent recorded in the second quarter of 2013 and 6.48 percent recorded in the corresponding quarter of 2012 as shown in Figure 1. The nominal GDP for the third quarter of 2013 was estimated at N11,166,026.39 million, up from the N10,967,272.89 million estimated for the corresponding quarter of 2012 by 1.81 percent, and N10,204,837.97 million recorded in the second quarter of 2013 by 9.41 percent

The economy can be broadly classified into two output groups: Oil and Non-oil sectors. Supply disruptions continue to hamper output in the oil sector. Non-oil sector output increased in the third quarter of 2013 however. The non-oil sector growth was driven by growth in activities recorded in the agriculture, hotels & restaurants, building & construction and telecommunications sectors.

Oil Sector

The average daily production of crude oil in the third quarter of 2013 was recorded at 2.26 mil-lion barrels per day, an increase from 2.11 mil-lion barrels per day recorded in the second quarter of the year. Crude production was however lower compared to the 2.52 million barrels per day recorded in the third quarter of 2012. These figures with their associated gas components, resulted in a decline in the growth (year-on year) of the value added of output in oil GDP by 0.53 percent for the third quarter of 2013, an increase from the negative 1.15 percent growth recorded in the second quarter of 2013 and but lower from the 0.08 percent growth recorded in the corresponding period of 2012.

While supply challenges continue to hamper production, the restoration of 400,000 barrel per day production during the quarter due to the re-opening of three major pipelines– The Trans Niger, Nembe Creek and Tebidaba– brass pipelines are welcome developments for crude production going forward.

The Oil sector contributed approximately 12.50 percent to real GDP in the third quarter of 2013, lower from the 12.90 percent contribution in the second quarter of 2013, and the 13.42 percent recorded during the third quarter of 2012.

Non-oil sector

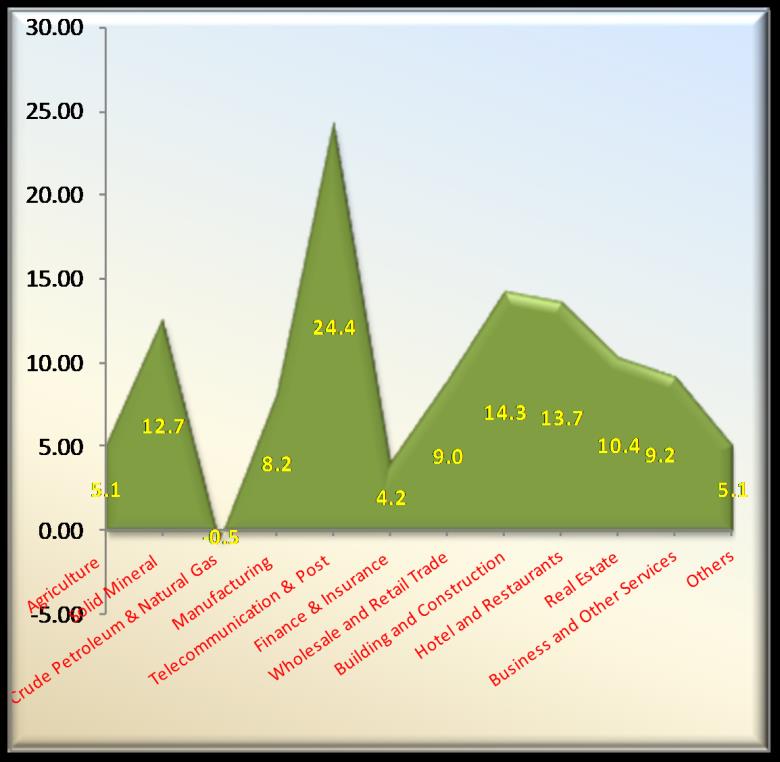

Despite the persistent challenges facing the oil sector, the non-oil sector continues to sustain the Nigerian economy. In the third quarter of 2013, the non-oil sector recorded 7.95 percent growth in real terms compared with 7.55 percent at the corresponding period in 2012, and 7.36 percent in the second quarter of 2013 as indicated in Figure 4. The 0.40 percentage point increase in growth (year-on-year) was largely driven by better performance in the agricultural sector; crop production in particular, banking and insurance activities, real estate, hotels and restaurants, building and construction, and solid mineral production. In what follows, the performance of the non-oil sector in the third quarter of 2013 is further analysed to give a better understanding of its contribution to Nigerian economy.

Agriculture

Agricultural output continues to experience improved production in 2013. Output in the third quarter of 2013 stood at 5.08 percent, up from the 3.89 percent recorded in the corresponding period of 2012 and also higher than the 4.52 percent re-corded during the second quarter of 2013. This represents the highest growth rate in the sector in the last eight quarters.

The growth recorded in the quarter points to improved output, as well as a recovery from the floods that were particular to the third quarter of 2012 impacting at least 25 out of the 36 States in Nigeria. Crop production and fishing in particular, showed improvements possibly as a result of pro-active attempts by the Federal government through the Federal Ministry of Agriculture.

Initiatives such as the dry season farming, supplying seeds and fertilizers directly to farmers, providing mechanised equipment at affordable rates as well as other reforms, resulted in increased output in 2013. Nevertheless, agricultural output remains largely supported by rainfall.

Finance & Insurance

The Finance and Insurance sub-sector comprises banking, insurance, pension and stock-broking firms. These firms operate in the various segments of the financial markets such as money market, capital market and the foreign exchange market. They play prominent role in ensuring an efficient financial intermediation in the economy.

Wholesale and Retail Trade

Growth in the Wholesale & Retail Trade sector stood at 9.03 percent in the third quarter of 2013, compared to 9.62 percent recorded in the third quarter of 2012 (See Figure 9). Growth was however higher when compared to the second quarter of 2013 which was recorded at 7.44 percent. The sector however remains the second largest contributor to GDP, after Agriculture.

While agricultural output, a key input in the sec-tor has aided production, intermittent electricity generation has dampened growth. The increase in growth recorded in the third quarter of 2013 was also attributed to the increase in consumer demand as the sector is affected by expectations for the festive activities in the fourth quarter.

As shown in Figure 8, this sector recorded a growth of 4.15 percent in the third quarter of 2013. While growth recorded in the quarter indicates a moderation of a full percent compared to 5.18 percent recorded in the second quarter of 2013, growth in the quarter is still marginally higher than 4.08 percent recorded in the third quarter of 2012 as economic participants looking to be more active engage financial intermediaries for support and mediation. The sector contribution to real GDP in the third 2013 declined slightly to 2.84 percent as against 2.92 percent recorded a year earlier.

Telecommunications & Post

The telecommunication sector recorded a real GDP growth of 24.42 percent in the third quarter of 2013, up from 22.12 percent recorded in the second quarter of the year. Year-on-year however, growth has slowed by 7.2 percentage points as 31.57 percent was the recorded in the third quarter of 2012 as shown in Figure 10.

Growth in the sector slowed in the third quarter of 2013 as a result of power supply and other infra-structure constraints. Effective demand by consumers coupled with highly competitive markets as a result of product differentiation and market strategies to cater to multiple market segments has resulted in higher value added services for operators. This indicates vibrant sector.

This increase was due partly to better output from oil refining and cement sectors. Other manufacturing activities outside of oil refining and cement production also indicate improved economic activity on the back of improved agricultural output, and higher demand on the part of consumers. Furthermore, output increased in the sector as firms ramped up production in anticipation of the festive season.

Real Estate Services

The growth recorded in the real estate services sector stood at 10.35 percent in the third quarter of 2013. When compared with the corresponding quarter in 2012, which was recorded at 10.24 percent, the growth rates exhibited in the third quarter of 2013 indicate higher economic performance of the sector. Growth in the second quarter of 2013 was recorded at 10.88 percent.

Manufacturing

During the third quarter of 2013, manufacturing output increased relative to the same period in 2012. Real GDP growth in the sector was re-corded at 8.16 percent, up from 6.81 percent re-corded in the second quarter of 2013, and 7.78 percent recorded in the corresponding quarter of 2012.

Business and Other services

The Business & Other Services sector recorded a real GDP growth of 9.20 percent in the third quarter of 2013 compared to 11.33 percent recorded in the second quarter of 2013, and the 9.11 percent recorded in the third quarter of 2012.

The decline in growth recorded in the third quarter of 2013 relative to its performance in the second quarter indicates slower economic growth largely related to infrastructural challenges. Year-on, there was a marginal improvement economic activity in the sector.